Nexstar Media Group Reports Record Second Quarter Net Revenue of $1,131.6 Million

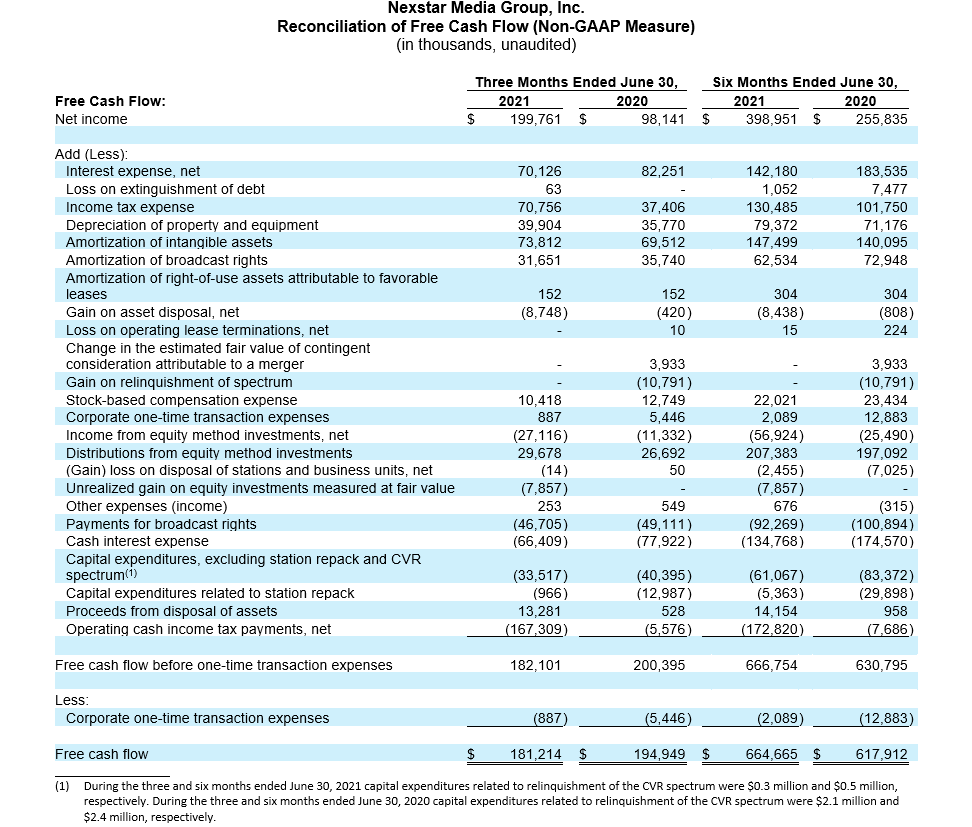

Net Revenue Drives 2Q Operating Income of $288.3 Million, Net Income of $199.8 Million, Adjusted EBITDA of $418.8 Million and Free Cash Flow of $181.2 Million

Returned $167.7 Million to Shareholders in the Second Quarter in the Form of Share Repurchases and Dividends

Raises Pro-Forma Average Annual Free Cash Flow Guidance for the 2021/2022 Cycle to Approximately ~$1.33 Billion

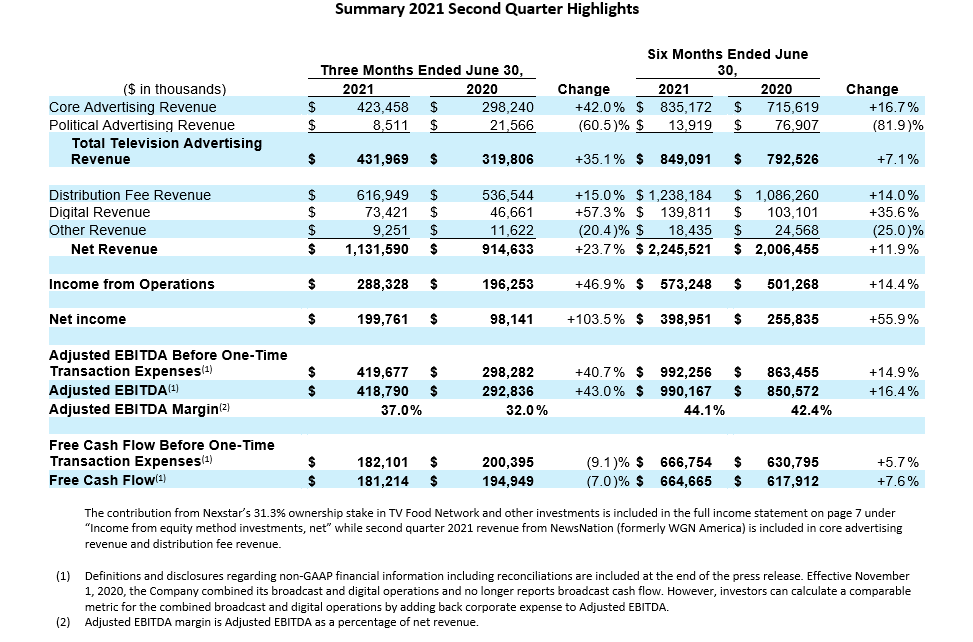

IRVING, Texas – August 4, 2021 – Nexstar Media Group, Inc. (NASDAQ: NXST) (“Nexstar” or “the Company”) today reported financial results for the second quarter ended June 30, 2021 as summarized below:

CEO Comment

CEO Comment

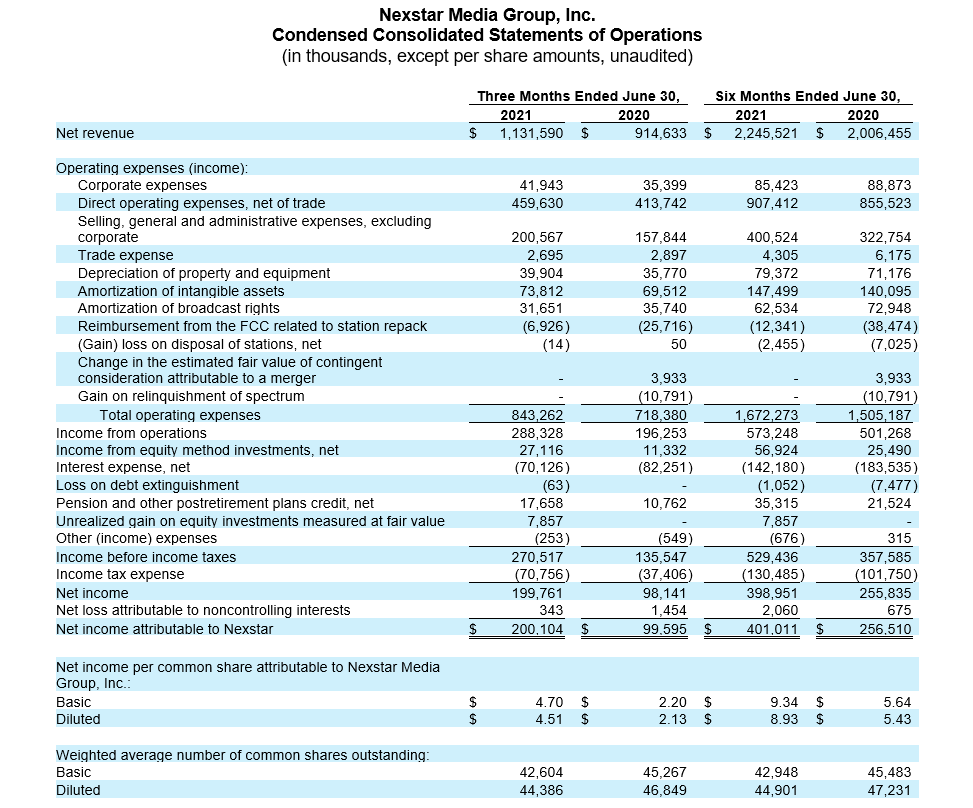

Perry A. Sook, Chairman and Chief Executive Officer of Nexstar Media Group, Inc. commented, “Nexstar’s strong operating and financial growth momentum as well as our commitment to enhancing shareholder value was highlighted again in the second quarter as we delivered another period of outstanding financial results and industry-leading capital returns. Record second quarter net revenue reflects our team’s success in generating a faster and stronger-than-anticipated recovery in core advertising as well as continued double-digit distribution revenue growth. Overall, our record second quarter net revenue of $1.13 billion, net income of $199.8 million and Adjusted EBITDA of $418.8 million were well ahead of consensus expectations, while free cash flow of $181.2 million was impacted by the timing of 2021 operating cash tax payments. With our year-to-date operating results pacing ahead of internal forecasts, we are raising our pro-forma average annual free cash flow guidance for the 2021/2022 cycle by $60 million to approximately ~$1.33 billion.

“During the second quarter, we remained active with our initiatives to enhance shareholder value, repurchasing approximately $138 million of our Class A common shares and returning approximately $30 million to shareholders through our quarterly cash dividend. Through the first six-months of 2021, Nexstar allocated approximately $319 million toward share repurchases and dividends, while maintaining total net leverage below 4x. As such, we are well on our way to exceed the $383 million in total capital returned to shareholders in full year 2020 during the current quarter. Our 2021 repurchase activity to-date, and the approximate $916 million remaining under our current share repurchase authorization, reflects the Board’s confidence in Nexstar’s solid financial position, the durability of our business model and our ability to continue delivering robust levels of free cash flow.

“Nexstar’s record second quarter net revenue increased 23.7% over the prior year, as we continue to successfully monetize our local content leading to significant year-over-year core and digital ad revenue growth, which more than offset the approximate $13 million year-over-year decline in political advertising. Total television advertising revenue, including political advertising revenue, increased 35.1% over the prior year reflecting a 42% rise in core advertising, outpacing expectations and highlighting growing demand for our premium local and national marketing solutions as the broad-based economic recovery continues across our markets. In addition, Nexstar’s local sales initiatives continue to deliver healthy levels of new business with our sales teams generating $32.9 million of second quarter new-to-television revenue, marking a 59% increase over the prior year and a 18% rise over first quarter 2021 levels. Nexstar’s new business strategies, ongoing sales training, and performance-focused incentive structure, all continue to prove highly effective in generating results and our local sales teams are working hard to drive further revenue share gains in the second half of the year.

“Second quarter 2021 distribution fee revenue rose 15% year-over-year to approximately $617 million, reflecting our renewal of distribution agreements in 2020 representing approximately 18% of our subscriber base, synergies related to Mission Broadcasting’s acquisition of WPIX-TV and stable subscriber trends across our platform that remain consistent with our expectations. As a result, Nexstar has solid visibility into our contractual distribution economics with over 85% of our Big Four affiliations contracted through December 31, 2022. As such, we expect continued retransmission revenue growth reflecting contract renewals representing a high-single digit percentage of our subscribers in 2021 and approximately 60% of our subscribers in 2022.

“Second quarter 2021 total digital revenue increased 57% to approximately $73.4 million with digital profitability up substantially over the prior year period. Top-line growth was driven by strong year-over-year growth in our local digital advertising revenue and agency services business, combined with contributions from the December 2020 accretive acquisition of Best Reviews, a leading consumer product recommendations company. Nexstar’s integrated content and audience development strategies continue to generate strong audience engagement with our media content and significant consumer digital usage across our digital network of 400+ digital touchpoints.

“During the second quarter, Mission Broadcasting closed on a new $300 million Term Loan B Facility. The net proceeds from Mission’s new Term Loan B Facility were used to pay down borrowings under its existing Revolving Credit Facility, pay shared service fees to Nexstar and for general corporate purposes. In addition, concurrent with the closing of the Term Loan B Facility, Mission re-allocated $255 million of its Revolving Credit Facility commitments to Nexstar’s Revolving Credit Facility. At quarter end, there was a total of $365.7 million available under the two Revolving Credit Facilities. The transaction had no material impact on Nexstar’s leverage profile. As always, we remain focused on actively managing our capital structure and continue to expect Nexstar’s net leverage, absent additional strategic activity, to be in the sub 4x range at the end of 2021.

“In June, Nexstar marked its 25th anniversary of the Company’s founding. Over the last two-and-a-half decades, the Company’s transformational growth and financial success have been driven by our revenue diversification strategies, disciplined approach toward capital allocation and an organization-wide commitment to localism and operational excellence. As the largest broadcast group and the top producer of local news programming in North America, Nexstar is mobilizing our resources at scale to leverage the many opportunities we see across the business over the near- and long-term to deliver growing levels of content monetization. To support our next phase of growth, last November we implemented a new operational structure by combining our broadcasting and digital operating subsidiaries under Nexstar Media Inc. to align the Company’s leadership in local content production with its management teams and promoted our Executive Vice President and Chief Financial Officer, Tom Carter, to President and Chief Operating Officer. In July, we announced that Lee Ann Gliha, an accomplished finance leader with more than 20 years of experience in TMT investment banking, will assume the CFO role from Tom. Lee Ann will be instrumental in advancing our strategic objectives. Overall, we are confident that the actions we have taken over the past year and the management team we have put in place positions Nexstar to continue providing outstanding content and service to our local communities, while extending our record of delivering exceptional financial results and industry leading risk-adjusted returns to our shareholders.

“In summary, our strategic priorities remain focused on serving our local communities and driving increased content monetization, while returning capital to shareholders, reducing leverage and making thoughtful investments in our business to drive future growth. Looking ahead, with Nexstar’s operating momentum across our businesses, we expect to generate year-over-year growth across all of our non-political revenue sources for the remainder of 2021. The solid foundation of our assets and operations combined with the resiliency of our business model give consistency to our results and our service to our local communities and local and national advertisers has never been stronger. As such, we continue to have excellent visibility to deliver on or exceed our upsized free cash flow targets in the 2021/2022 cycle as well as a clear path for the continued near- and long-term enhancement of shareholder value.”

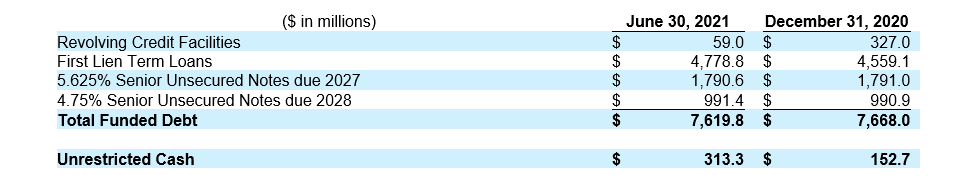

The consolidated debt of Nexstar and Mission Broadcasting, Inc., an independently owned variable interest entity (collectively with Nexstar, the “Company”) at June 30, 2021, was $7,619.8 million including senior secured debt of $4,837.8 million. The Company’s first lien net leverage ratio at June 30, 2021 was 2.1x compared to a covenant of 4.25x. The Company’s total net leverage ratio at June 30, 2021 was 3.3x.

The table below summarizes the Company’s debt obligations (net of financing costs and discounts).

Share Repurchase Authorization and Activity

The Company repurchased a total of 926,162 shares of its Class A common stock in the second quarter of 2021 at an average price of approximately $148.83 per share for a total cost of $138 million, which was funded from cash flow from operations. Reflecting all shares repurchased to date, Nexstar has approximately 42 million shares of Class A common stock outstanding (the only class of shares outstanding) and has approximately $916 million available under its share repurchase authorization.

Second Quarter Conference Call

Nexstar will host a conference call at 9:00 a.m. ET today. Senior management will discuss the financial results and host a question-and-answer session. The dial in number for the audio conference call is 334/777-6978, conference ID 4869641 (domestic and international callers). Participants can also listen to a live webcast of the call through the “Events and Presentations” section under “Investor Relations” on Nexstar’s website at www.nexstar.tv. A webcast replay will be available for 90 days following the live event at www.nexstar.tv.

Definitions and Disclosures Regarding non-GAAP Financial Information

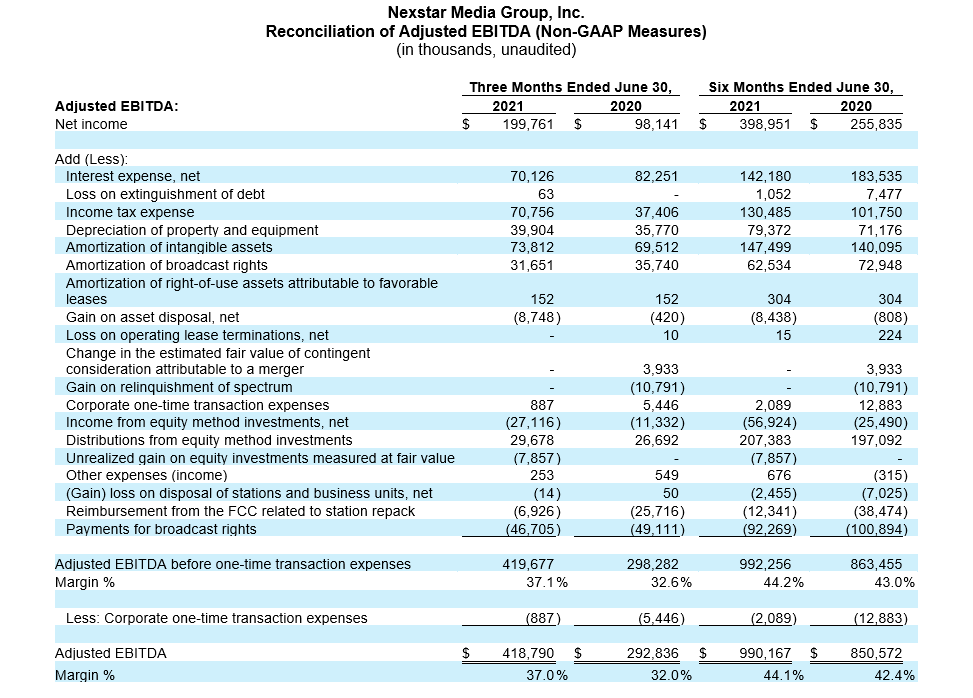

Adjusted EBITDA is calculated as net income, plus interest expense (net), loss on extinguishment of debt, income tax expense (benefit), depreciation, amortization of intangible assets and broadcast rights, (gain) loss on asset disposal, goodwill and intangible assets impairment, loss (income) on equity investments, distribution from equity investments and other expense (income), minus reimbursement from the FCC related to station repack and broadcast rights payments. We consider Adjusted EBITDA to be an indicator of our assets’ operating performance and a measure of our ability to service debt. It is also used by management to identify the cash available for strategic acquisitions and investments, maintain capital assets and fund ongoing operations and working capital needs. We also believe that Adjusted EBITDA is useful to investors and lenders as a measure of valuation and ability to service debt.

Effective November 1, 2020, the Company combined its broadcast and digital operations and no longer reports broadcast cash flow. However, investors can calculate a comparable metric for the combined broadcast and digital operations by adding back corporate expense to Adjusted EBITDA.

Free cash flow is calculated as net income, plus interest expense (net), loss on extinguishment of debt, income tax expense (benefit), depreciation, amortization of intangible assets and broadcast rights, (gain) loss on asset disposal, stock-based compensation expense, goodwill and intangible assets impairment, loss (income) on equity investments, distribution from equity investments and other expense (income), minus payments for broadcast rights, cash interest expense, capital expenditures, proceeds from disposals of property and equipment, and operating cash income tax payments. We consider Free Cash Flow to be an indicator of our assets’ operating performance. In addition, this measure is useful to investors because it is frequently used by industry analysts, investors and lenders as a measure of valuation for broadcast companies, although their definitions of Free Cash Flow may differ from our definition.

For a reconciliation of these non-GAAP financial measurements to the GAAP financial results cited in this news announcement, please see the supplemental tables at the end of this release.

With respect to our forward-looking guidance, no reconciliation between a non-GAAP measure to the closest corresponding GAAP measure is included in this release because we are unable to quantify certain amounts that would be required to be included in the GAAP measure without unreasonable efforts and we believe such reconciliations would imply a degree of precision that would be confusing or misleading to investors. In particular, a reconciliation of forward-looking Free Cash Flow to the closest corresponding GAAP measure is not available without unreasonable efforts on a forward-looking basis due to the high variability, complexity and low visibility with respect to the charges excluded from these non-GAAP measures such as the measures and effects of stock-based compensation expense specific to equity compensation awards that are directly impacted by unpredictable fluctuations in our stock price and other non-recurring or unusual items such as impairment charges, transaction-related costs and gains or losses on sales of assets. We expect the variability of these items to have a significant, and potentially unpredictable, impact on our future GAAP financial results.

About Nexstar Media Group, Inc.

Nexstar Media Group (NASDAQ: NXST) is a leading diversified media company that leverages localism to bring new services and value to consumers and advertisers through its traditional media, digital and mobile media platforms. Its wholly owned operating subsidiary, Nexstar Media Inc., consists of three divisions: Broadcasting, Digital, and Networks. The Broadcasting Division operates, programs, or provides sales and other services to 199 television stations and related digital multicast signals reaching 116 markets or approximately 39% of all U.S. television households (reflecting the FCC’s UHF discount). The division’s portfolio includes primary affiliates of NBC, CBS, ABC, FOX, MyNetworkTV and The CW. The Digital Division operates 120 local websites and 284 mobile apps offering hyper-local content and verticals for consumers and advertisers, allowing audiences to choose where, when and how they access content and creating new revenue opportunities for the company. The Networks Division operates NewsNation, formerly WGN America, a national news and entertainment cable network reaching 75 million television homes, multicast network Antenna TV, and WGN Radio in Chicago. Nexstar also owns a 31.3% ownership stake in TV Food Network, a top tier cable asset. For more information, please visit www.nexstar.tv.

Forward-Looking Statements

This communication includes forward-looking statements. We have based these forward-looking statements on our current expectations and projections about future events. Forward-looking statements include information preceded by, followed by, or that includes the words “guidance,” “believes,” “expects,” “anticipates,” “could,” or similar expressions. For these statements, Nexstar claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. The forward-looking statements contained in this communication, concerning, among other things, future financial performance, including changes in net revenue, cash flow and operating expenses, involve risks and uncertainties, and are subject to change based on various important factors, including the impact of changes in national and regional economies, the ability to service and refinance our outstanding debt, successful integration of acquired television stations and digital businesses (including achievement of synergies and cost reductions), pricing fluctuations in local and national advertising, future regulatory actions and conditions in the television stations’ operating areas, competition from others in the broadcast television markets, volatility in programming costs, the effects of governmental regulation of broadcasting, industry consolidation, technological developments and major world news events. Nexstar undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this communication might not occur. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this release. For more details on factors that could affect these expectations, please see Nexstar’s other filings with the Securities and Exchange Commission.

Investor Contacts:

Thomas E. Carter

President, Chief Operating Officer and Chief Financial Officer

Nexstar Media Group, Inc.

972/373-8800

Joseph Jaffoni, Jennifer Neuman

JCIR

212/835-8500 or nxst@jcir.com

Media Contact:

Gary Weitman

EVP and Chief Communications Officer

Nexstar Media Group, Inc.

312/222-3394 or gweitman@nexstar.tv

-tables follow-

# # #

Click here for a PDF version of the release.